Review of the week: The cycle of hope

When you really want some thing to happen, it’s hard to be objective about it. You focus on the reasons why it will happen and explain away any suggestion that it won’t. Investors have been guilty of this while dreaming ceaselessly of American interest rate cuts over the past year or more.

Article last updated 13 October 2025.

Quick take:

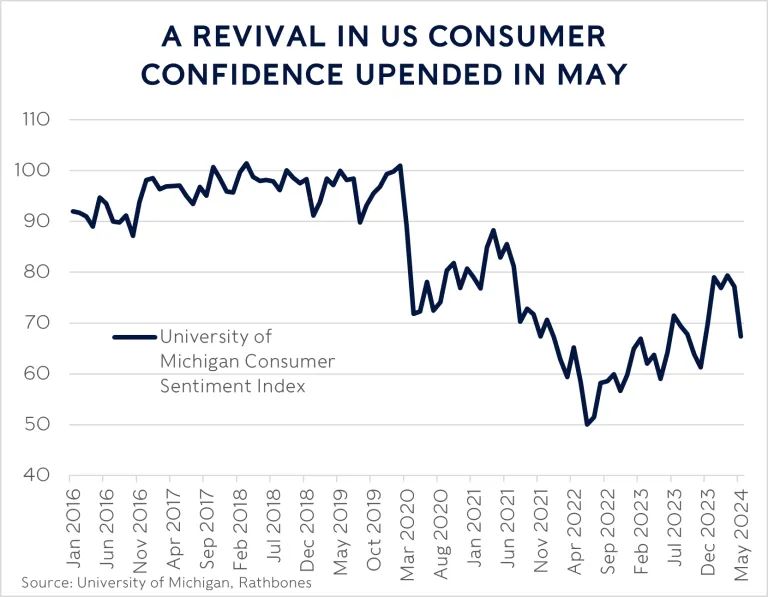

- US jobs growth slowed significantly in April, with nonfarm payrolls dropping to 175,000 from 315,000 the previous month

- The University of Michigan Consumer Sentiment Survey plummeted from 77.2 to 67.4 in May as Americans became more downbeat on inflation

- The number of Bank of England policymakers voting to cut interest rates doubled to two last week, raising expectations of a summer cut in the UK

When you really want some thing to happen, it’s hard to be objective about it. You focus on the reasons why it will happen and explain away any suggestion that it won’t. Investors have been guilty of this while dreaming ceaselessly of American interest rate cuts over the past year or more.

We’ve talked often about why US interest rates matter – they are the bedrock ‘risk-free’ rate of return on which all other rates of return and borrowing are measured. When the US rate changes, all other rates change with it. And that affects the value of virtually every asset in the world. When American rates rose rapidly in 2022 and early 2023, it sent markets tumbling. Particularly bonds, as they are more susceptible to such fluctuations because, unlike stocks that can pay out more profits, their returns are fixed. In the 18 months since, investors have hankered for the reverse: for rates to fall, which would boost the value of global assets. It’s been a long wait.

This has led to a cycle where hopes of coming rate cuts are kindled by batches of weaker economic or inflation data only to be dashed by stronger data elsewhere. We’ve been through a few of these over the past nine months or so, which has made bonds particularly volatile recently. And we’re in the middle of one now. US government bond yields spiked in April after inflation continued to reaccelerate, yet since then US economic growth has eased and jobs growth has slowed dramatically. US Treasury yields have fallen back from last month’s level as hopes grow that the US Federal Reserve (Fed) will be able to reduce interest rates this year. So will this data cycle end in disappointment too, or will the Fed finally arrive at the off ramp?

Since the end of the pandemic, US households have been extraordinarily strong, with wages growing steadily – even after inflation – and jobs easy to come by. That’s driven greater retail spending, helped no doubt by a strong dollar that makes imports and holidays abroad much cheaper. Yet consumer confidence took an unexpected and big fall in April (see the chart below), which further bolsters the argument for a cut in rates.

Or does it? While a sinking mood tends to rein in spending and therefore generally ease upwards pressure on the prices of goods and services, the potential cause of this slump in sentiment contradicts this argument. There was little obvious reason for the big drop in confidence, given the stock market has been strong and oil prices weaker, yet households’ expectations of future inflation increased noticeably. The average respondent thought inflation would be 3.5% a year from now, up from 3.2% the previous month. And the average five-year forecast nudged up to 3.1% from 3.0%. Now, this is only one month’s data, yet inflation expectations are important because they can become self-fulfilling.

US CPI inflation will be released on Wednesday. It’s forecast to moderate slightly, from 3.5% to 3.4%. Meanwhile, core CPI inflation (which removes volatile energy and food) is expected to fall by a fifth of a percentage point to 3.6%. If the predictions come true, hopes of rate hikes will heighten further. Any disappointment will send the cycle round again.

| Index |

1 week |

3 months |

6 months |

1 year |

| FTSE All-Share |

2.7% |

12.5% |

17.0% |

13.0% |

| FTSE 100 |

2.8% |

13.1% |

16.9% |

13.4% |

| FTSE 250 |

2.4% |

9.4% |

17.6% |

10.9% |

| FTSE SmallCap |

1.9% |

8.6% |

16.3% |

11.5% |

| S&P 500 |

2.2% |

5.3% |

16.2% |

29.3% |

| Euro Stoxx |

3.7% |

10.5% |

19.5% |

17.5% |

| Topix |

-1.6% |

4.2% |

11.9% |

16.4% |

| Shanghai SE |

2.2% |

10.7% |

2.2% |

-8.1% |

| FTSE Emerging |

1.0% |

9.9% |

11.7% |

14.5% |

Source: EIKON, data sterling total return to 10 May

| These figures refer to past performance, which isn’t a reliable indicator of future returns. The value of investments and the income from them may go down as well as up and you may not get back what you originally invested. |

For once, Europe leads the way

The situation is a little different on this side of the Atlantic.

Here in the UK, the economy returned to growth in the first quarter after a short and shallow recession in the second half of last year. GDP rose by 0.6% on the previous quarter, higher than the 0.4% forecast. Inflation has been marching steadily downward. The Bank of England (BoE) is expected to cut interest rates twice this year, with the first virtually nailed on for August (with a healthy chance of it coming next month, according to markets). At last week’s monetary policy meeting, the BoE committee voted 7-2 to hold the rate where it was – two voted for a cut, compared with a single vote at the last meeting.

The general feeling was that BoE Governor Andrew Bailey was pretty ‘dovish’ – keen for cutting rates – and setting the scene for a looming reduction in the rate. We are quietly confident that rate cuts will arrive soon in the UK – much more so than in the US. Yet it’s important to remember that risks remain to that view. As the BoE itself noted in its minutes of last week’s meeting, while falling, inflation is still more than one percentage point above the 2% target. And inflation in services (businesses such as pubs, hotels, accounting firms and insurance) is still running at a whopping 6.0%. Services is an overwhelming portion of the British economy. This will need to cool if inflation is to be brought under control. Encouragingly, the three-month rate of change has averaged just 1.5% annualised this year, so it may be that the work has already been done.

On the Continent, the Swedish central bank cut its benchmark rate by a quarter percentage point to 4.75% last week. That follows a cut of the same size by the Swiss central bank to 1.5% in March. The European Central Bank has telegraphed that it will cut its rate by a quarter percentage point to 4.25% next month as long as wages and inflation remain in check. Eurozone inflation will be released this Friday. The headline rate is expected to remain at 2.4%, while the core rate is forecast to drop from 2.9% to 2.7%.

If you have any questions or comments, or if there’s anything you would like to see covered here, please get in touch by emailing review@rathbones.com. We’d love to hear from you.

.coh-style-button--primary:after { content: ' '; }DOWNLOAD PDF