When you’re focused on managing and scaling your business, it’s easy to overlook your personal finances. Here are some key tips to help ensure long-term financial stability for yourself and your family.

Building Financial Resilience As A Female Entrepreneur

Article last updated 16 December 2024.

Starting and growing a business can be one of the most exciting and fulfilling career paths, but it’s also a balancing act that demands time and energy. We understand that with the many demands female entrepreneurs face, it’s easy for you to put your financial planning on hold.

Yet investing in your own financial future is just as important as investing in your business. Make sure you take advantage of opportunities to protect and grow your personal wealth by prioritising your long-term financial plans.

FINANCIAL MATTERS

Here are some key financial areas for female entrepreneurs to consider:

Risk appetite

Business owners often prefer lower-risk investment options or cash savings for their personal finances. Consider strategies to balance cautious habits with opportunities for long-term growth.

Business versus employee benefits

Entrepreneurs miss out on employee benefits like pensions, sick pay and medical insurance. Steps such as setting up a personal pension or private insurance can help bridge these gaps.

Financial security while building your business

Protect yourself with financial products like income protection, critical illness cover and a clear strategy for managing personal finances, including salary and dividends.

Pension provision

Ensure consistent contributions to a personal pension, even during periods of reinvestment in your business. This helps build a stable foundation for retirement.

Protect your business

Safeguard your company’s future with measures like cash flow management, shareholder agreements, shareholder insurance and key person insurance. Business Lasting Power of Attorney arrangements can also ensure continuity in case of unforeseen circumstances.

Planning to sell your business

Determine your reasons for selling and calculate how much is ‘enough’ through cash flow modelling (a process that forecasts your future finances). Pre-exit planning with your legal, accounting and financial advisers can position your business for maximum value and tax efficiency.

System and process readiness

Before selling, ensure your business is operationally efficient and systems are in place to make it attractive to buyers.

Create a plan for yourself

Post-sale, focus on implementing your financial plan, including reinvesting proceeds into ISAs, pensions and other instruments to generate income or fund future ventures.

Passing wealth to your family

Use strategies like inheritance tax planning, gifting and trusts to transfer wealth tax efficiently.

Real estate

Explore opportunities for onshore and offshore real estate investments, considering how they fit into your long-term wealth-building or income-generating strategy.

Giving and philanthropy

Channel your wealth into charitable causes that align with your values, creating a meaningful legacy while benefiting from potential tax advantages. By addressing these areas, female entrepreneurs can ensure their financial futures are as secure and successful as their businesses.

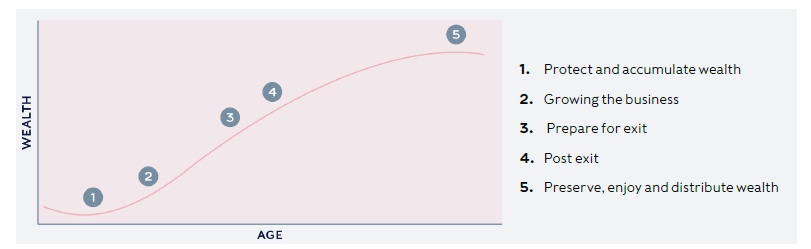

FINANCIAL PLANNING ACROSS LIFE STAGES

This diagram illustrates the progression of wealth through key stages in an entrepreneur’s journey. During the growth phase, the focus is on building and accumulating wealth. As retirement or a business exit approaches, the emphasis shifts to preserving it. In the post-exit phase, the goal becomes enjoying and distributing wealth while planning for the future. Understanding your current phase can help identify the right strategies for financial growth and security.

Early working life: laying the foundation

In the early stages of your career, the focus is on protecting and growing wealth while managing living expenses. This involves safeguarding your financial stability against risks like illness or loss of earnings, ensuring security for yourself and your family, and balancing savings with maintaining your standard of living. During this ‘accumulation phase’, strategies like tax-efficient ISA and pension contributions come into play, alongside carefully chosen investments that match your risk tolerance. However, this stage is not without challenges. Events such as maternity leave or reduced working hours to care for young children or elderly parents can significantly impact earnings and reduce the income available for future savings.

Approaching exit: preparing for the next chapter

As you approach the sale or transition of your business, financial priorities shift toward maximising the value of your exit while planning for your future. At this stage, creating a clear, tax-efficient strategy for managing the proceeds is essential. Steps such as optimising personal income allowances and ensuring your business is operationally efficient can help secure a smooth transition. Balancing the preservation of wealth with your post-exit goals – whether they include new ventures or lifestyle – becomes a key focus. Thoughtful preparation during this critical phase can help position you for long-term financial security and a fulfilling next chapter.

Life after exit: managing wealth and legacy

After exiting your business, the focus shifts to managing your newfound financial freedom and aligning your wealth with your long-term goals. This stage often involves ensuring the proceeds from your business sale are structured to provide lasting financial security while enabling you to pursue new ventures, passions or philanthropic endeavours. Planning for future expenses, such as healthcare, and creating a strategy for wealth distribution – whether through gifting, trusts or charitable contributions – can help you build a meaningful legacy. With changing legislation and personal circumstances, estate planning becomes a critical part of ensuring your wealth benefits future generations while reflecting your values.

Effective financial planning begins with understanding your priorities and reflecting on what matters most to you. Setting clear goals and objectives, then reviewing them regularly with a financial planner, ensures your plans remain aligned with your needs and aspirations, fostering confidence in your financial wellbeing.

HOW CAN A FINANCIAL PLANNER HELP?

Speaking to a financial planner can provide the guidance needed to secure your financial future by addressing the unique challenges you face:

Personalised financial strategy

Tailored advice that aligns with your life stages and business goals, including tax-efficient saving and investing.

Cash flow and risk management

Guidance on balancing risk and growth through diversified investments, helping you avoid overly conservative habits that could limit potential returns.

Retirement and succession planning

Help in filling pension gaps, optimising contributions and planning for business transitions or eventual sale.

Planning for the unexpected

Prepare for illness or business disruption with insurance policies and emergency savings.

WHY RATHBONES?

When it comes to organising your finances and investing your money, expert advice can make all the difference. By taking control today and planning for tomorrow, Rathbones can help you make the most of your money - aiming to support you in building a secure financial future for yourself and your family.

What can you expect when you come to us for advice? First, you’ll meet with a qualified financial planner or investment manager to discuss your situation and goals. We’ll explain our services and provide all the information you need to understand our approach, including our fees.

You can decide how you’d like to work with us – choosing financial planning or investment management as individual services, or combining the two into a comprehensive wealth management approach.

We also offer services tailored to female entrepreneurs, including financial awareness courses and our Inspire community. Our collaborative approach means we work well with your other professional advisers, such as accountants, to ensure every aspect of your financial plan is optimised. This spirit of entrepreneurship is why Rathbones is positioned to support today’s founders on their financial journey.

If you’d like to know more, please click here to find out how to get in touch with us. With offices all over the UK, you can arrange meetings in person and gain access to expertise for the support you need.

FIVE AREAS TO CONSIDER FOR YOUR FINANCIAL FUTURETaking charge of your finances now can set you up for future success. Here are some practical tips to help you stay on track while growing your business: 1. Segregate your finances 2. Invest for long-term growth 3. Contribute to a personal pension 4. Plan for life events 5. Develop a succession or exit strategy By addressing these key areas, you can balance business growth with personal financial security. |

GET INSPIREDThrough Inspire by Rathbones, we are committed to fostering the growth of the UK’s economy. This initiative supports entrepreneurs by providing networking opportunities, expert insights, and events. We help founders navigate challenges like capital raising, client management and talent acquisition, offering exclusive content and advice, with no cost – only a commitment to active participation. Rathbones began as a family timber business in 18th century Liverpool and has evolved into a leading wealth manager. Our entrepreneurial spirit and commitment to ethical values continue to shape the company today. We focus on long-term value creation, supporting entrepreneurs and family businesses, while promoting responsible investment practices. A significant part of our legacy is Eleanor Rathbone, a pioneering social reformer and suffragist who became the first woman to serve on Liverpool City Council. Her groundbreaking work advocating for family allowances and humanitarian causes continues to inspire our approach. For more details, visit Rathbones Inspire. |

MOVING FORWARD: MAKING THE MOST OF LIFE AFTER EXITExiting your business opens the door to new opportunities and challenges. This stage is about managing your wealth thoughtfully, exploring new ventures and creating a plan for the future. Below are five key areas to focus on as you navigate life beyond your business: 1. Structuring your wealth 2. Planning for future expenses 3. Pursuing new ventures 4. Building a legacy 5. Adapting to your new role By addressing these areas with careful planning and expert advice, you can make the most of your post-exit journey and work towards securing your financial legacy. |

Get in touchIf you'd like to know more, please get in touch with us. With offices all over the UK, you can arrange meetings in person and gain access to expertise for the support you need. |