Some £1.2 billion is lost to investment scams every year in the UK. Contrary to popular perception, it is not just the elderly who are susceptible. Experienced investors are often targeted, and the embarrassment of those who fall victim is key to the fact that only 10% of such crimes are reported. We offer some useful warnings and advice.

Be a ScamSmart investor

Article last updated 20 December 2023.

Sarah Owen-Jones, Chief Risk Officer, Rathbones

The Financial Conduct Authority (FCA) recently launched its ScamSmart campaign to help investors, particularly retirees, avoid the financial losses and emotional distress of being scammed. Over-65s with savings in excess of £10,000 are three and a half times more likely to fall victim to investment fraud. This campaign has particular appeal to us given many of our clients are in this age group.

In 2016, victims of investment fraud lost on average £32,000 as fraudsters employed advanced psychological techniques to persuade victims to invest. Investing through an unauthorised firm gives you no protection from the Financial Ombudsman Service or Financial Services Compensation Scheme if things go wrong.

Most of us think that scams happen to other people and, if we are honest, we tend to believe that those who fall for them must be particularly credulous. That may be true of the “send £25,000 to release your £3 million inheritance” emails from officials at fictitious Nigerian banks. But most scams are far cleverer than this: they are deliberately designed to exploit our belief that we could never fall for such tricks.

Many victims are educated people with investment experience — perversely, it is this that makes them susceptible to fraud. Scams are often operated from the UK and may involve investments in wine, precious stones or carbon. In addition, the person making the call may not realise that they are involved in a scam — they may believe they are working for a legitimate company, making them even more persuasive.

Fraudsters are focusing on over-55s because they are more likely to have money to invest. They typically target experienced investors: low interest rates are a key factor in successful frauds as investors seek higher returns. The initial contact is likely to be a cold call, but fraudsters often pretend they are not calling out of the blue. They may, for example, refer to a brochure or email that they claim to have sent you.

That is why it is important you know the other tell-tale signs that suggest an investment opportunity is likely to be very risky or a scam. They may do one or more of the following:

- apply pressure on you to invest in a time-limited offer, offer you a bonus or discount if you invest before a set date, or say that the opportunity is only available for a short period of time.

- downplay the risks to your money, or use legal jargon to suggest the investment is very safe.

- promise tempting returns, offering much better interest rates than those offered elsewhere.

- call you repeatedly and stay on the phone a long time.

- say that they are only making the offer available to you, or even ask you to not tell anyone else about the opportunity.

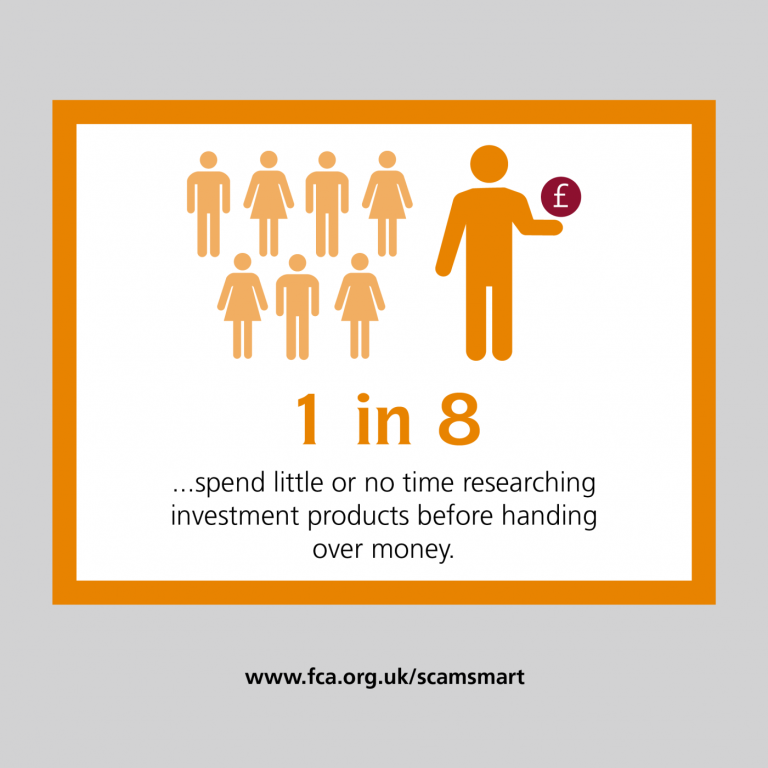

The FCA conducted a survey on attitudes to investment opportunity awareness and interestingly those surveyed were more aware of certain signs of investment fraud, but less aware of others. For example, 92% agreed being contacted out of the blue could be a warning sign, but 19% were unaware that being promised returns above the market rate could also be a tactic.

Mark Steward, Director of Enforcement at the FCA, advises: “Be alert to the warning signs like being contacted out of the blue, promises of low risk and/or guaranteed above-market returns, special deals just for you, time pressure and, very often, flattery.

“Be vigilant. Don’t let them push you into making a decision and parting with your money. Question their claims. Check the FCA Register and seek impartial advice. If in any doubt — don’t invest.”

At Rathbones, we experience our fair share of attempted scams. We believe you can never be too careful. We always try to help clients to achieve their aims and will process transactions as quickly as we can while following clear processes and taking the time to ensure that things are what they seem.

Find out more at fca.org.uk/ScamSmart

Nick Hewer, who is supporting the campaign, says:

" As someone who has been approached by scammers myself, I know how hard it is to identify whether an investment offer is legitimate. These people are very clever, playing psychological games to win over the trust of often vulnerable victims, and that’s why I’m working with the FCA to raise awareness of this troubling issue.

"Remember, if it sounds too good to be true then it probably is. If you are offered an attractive investment out of the blue, be suspicious, check the FCA’s Warning List and seek impartial advice. Better still, if you get a cold call, just put the phone down!”