Foreign investors have long regarded the Japanese stock market as akin to a samurai defeated in battle, sitting in his crumbling castle and ruminating on the bittersweet memory of his glory years.

Japanese equities are coming into the light

Article last updated 30 August 2023.

Foreign investors have long regarded the Japanese stock market as akin to a samurai defeated in battle, sitting in his crumbling castle and ruminating on the bittersweet memory of his glory years. Granted, Japan’s Topix stock index has never returned to the stratospheric level of close to 2,900 reached in 1989, shortly before the market bubble burst. However, it has surged this year to a 33-year high, helped by increasing interest from overseas investors. We think this interest is justified for several reasons, and still see a lot of potential for Japanese companies.

One is price. The market is cheap, both by its own past standards and compared with others. By historical standards, our composite measure of stock market valuation is well below its median since 2000. This lumps together numbers such as the forward price-earnings ratio, which divides the price of shares by estimated earnings per share for the year ahead. The price-earnings ratio of 14 is below the global average.

Sometimes stocks — and markets as a whole — are cheap for a reason. However, we see several factors that should boost stock prices. One is the ratcheting up of the pressure on Japanese companies to do better for shareholders.

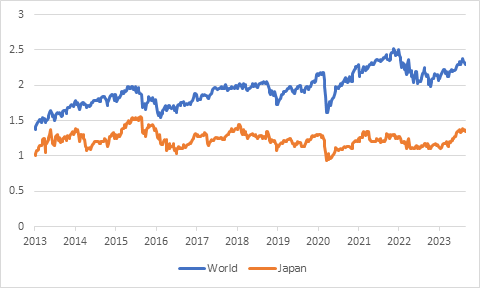

Recent rule changes at the Tokyo Stock Exchange have added fresh impetus to a long-running trend of improving shareholder value. Companies persistently trading below their book values — and these companies account for roughly half of the Topix — now need to disclose plans to remedy this. In practice, this encourages companies with large piles of idle cash — of which there are many in Japan — either to put the money to work by investing it or to return it to shareholders to reinvest elsewhere. There’s already evidence of the latter happening, with companies buying back more of their own shares. You can see a significant rise this year in the price-to-book value of Japanese stocks in the chart below.

Restive shareholders

Pressure does not come just from the Tokyo Stock Exchange. Shareholders are also growing progressively more restive. The number of activist funds in Japan has risen from under 10 in 2014 to nearly 70 this year, according to the Financial Times. These funds corral other shareholders into pressing for corporate change to unlock value for shareholders. The number of shareholder proposals submitted by activists has also surged. It has risen from fewer than the number of fingers on one hand in 2015 to nearly 60 last year, according to local investment bank Mizuho Securities — with a fresh record expected this year.

We also like corporate Japan’s pedigree of technological excellence. This puts companies at the forefront of technologies to make the global economy net zero. For instance, a public-private partnership has built the world’s largest hydrogen plant powered by renewable energy — the ‘green hydrogen’ much desired by governments — in Fukushima.

We are also heartened by improvements in the domestic economy. It is recovering strongly, but without the extremely high inflation and need for aggressive monetary tightening seen in the major Western economies. Japan’s stock market prospects are not reliant on the domestic economy, because the market is dominated by export-focused companies. But higher domestic demand is still helpful.

Lastly, Japan’s market benefits from a useful negative: the ‘not China’ trade. As a democracy, Japan is not at risk of the sudden crackdowns on companies or entire sectors that have provoked the ire of an autocracy, such as China’s 2021 ban on the tutoring industry making a profit from tutoring primary and middle school students. Japan is also gaining from the ‘friendshoring’ trend, where western countries move supply chains from China to countries with more amicable relations. For example, in May seven large chipmakers set out plans to increase manufacturing and deepen tech partnerships in Japan. China also remains an important market for Japanese exports.

While the Japanese economy faces headwinds from an ageing population and low birth rate, we don’t see these factors negating the benefits of its corporate reforms, thriving service industry and potential global leadership in digitalisation. These should continue to support a positive outlook for Japanese equities.

Measuring stock market value The prices of Japanese equities relative to book value (P/B) are below the global average, which suggests the country’s stock market represents good value for investors at the moment.

Source: Refinitiv, Rathbones.